This article applies to customers in Europe or Australia. Throughout the article, we use VAT as the general term for the tax that is included in the retail price of your products. If you are in Australia, just substitute the VAT term for GST as you read through the article.

In this article, we will demonstrate how BridalLive calculates VAT and show which Report to run to determine how much VAT to remit/reclaim. If you have not already, setup BridalLive for VAT, please do so before proceeding.

There are a few places where you'll see a calculated VAT amount appear within BridalLive. These places are:

- Point of Sale Transactions

- Purchase Orders & Receiving Vouchers

- VAT Report

Let's take a closer look at this and explain how BridalLive is making the calculations.

VAT on Point of Sale Transactions

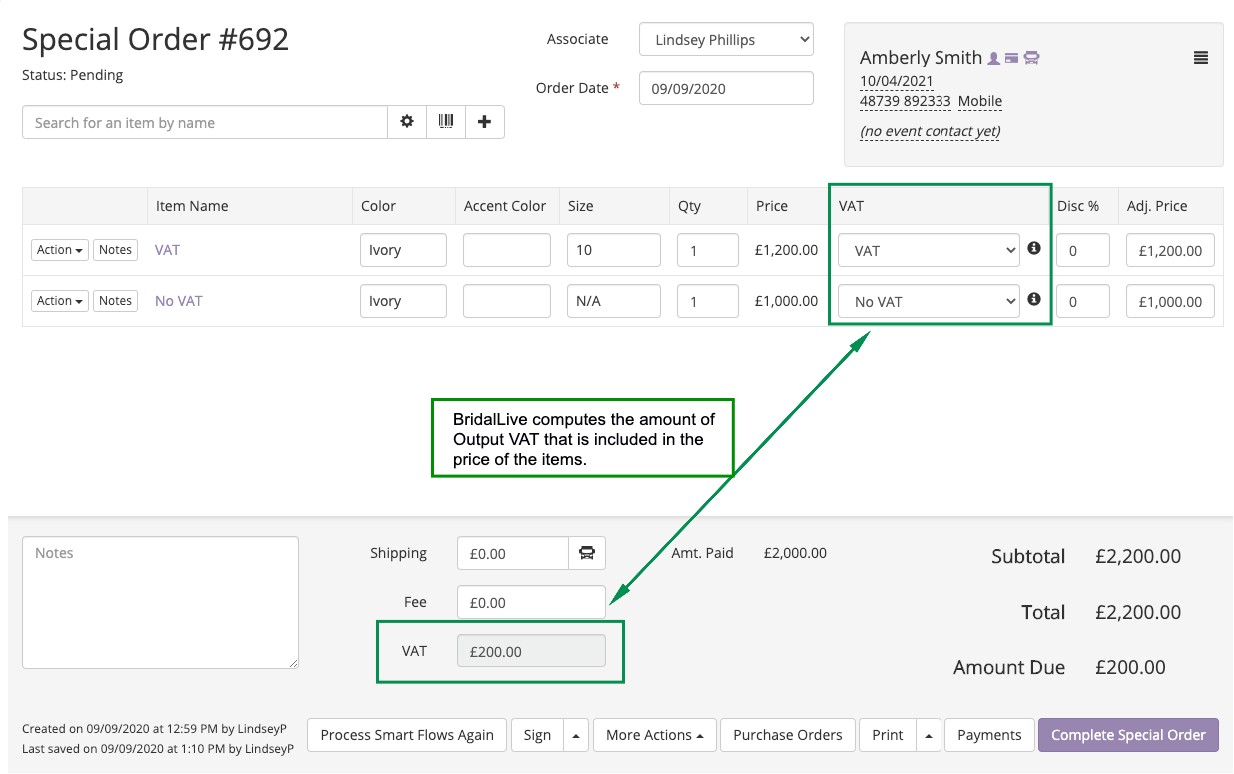

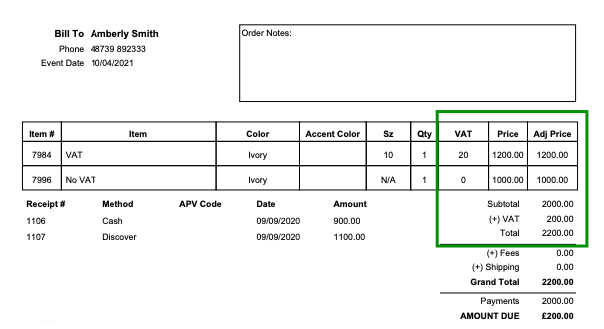

The 2 screenshots below show how Output VAT is handled on the POS Transactions.

(Notice how BridalLive calculates the amount of Output VAT that has been included in the price)

Purchase Orders and Receiving Vouchers

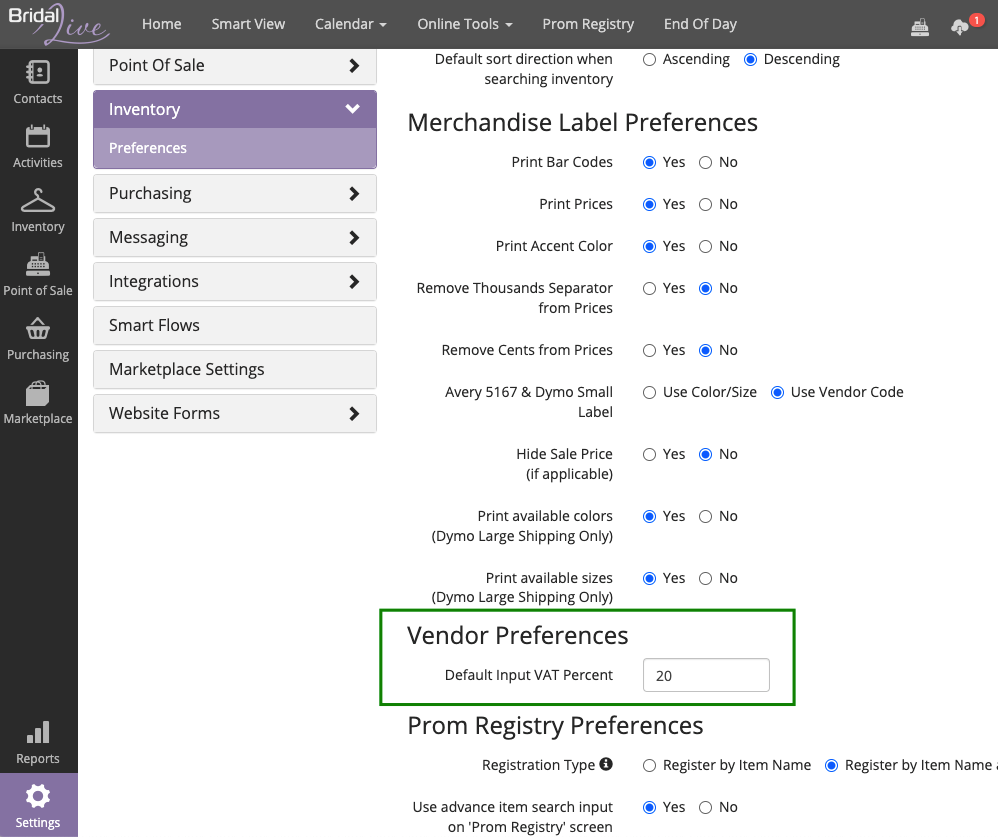

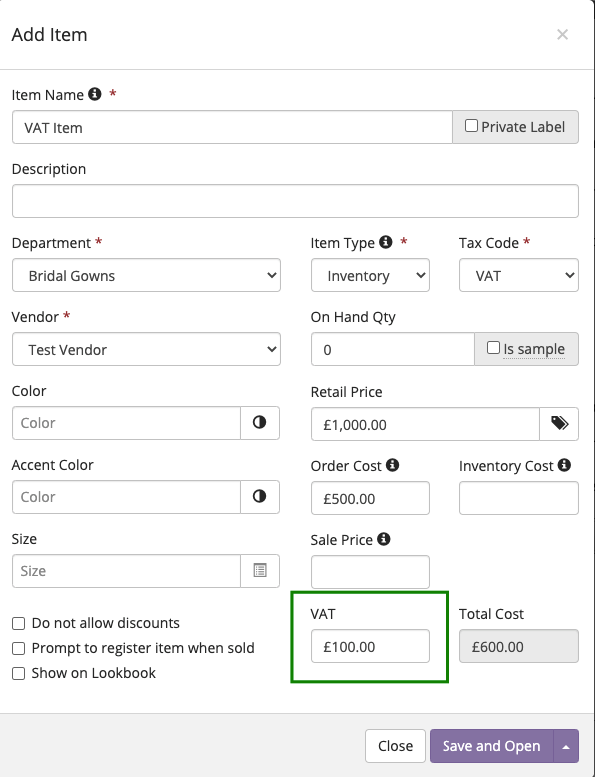

When purchasing merchandise from vendors, BridalLive will show the amount of Input VAT that is being paid for the item. This amount is retrieved from the VAT amount on the Item Screen. You can set the default input VAT percent for adding vendors to BridalLive in Settings > Inventory Preferences.

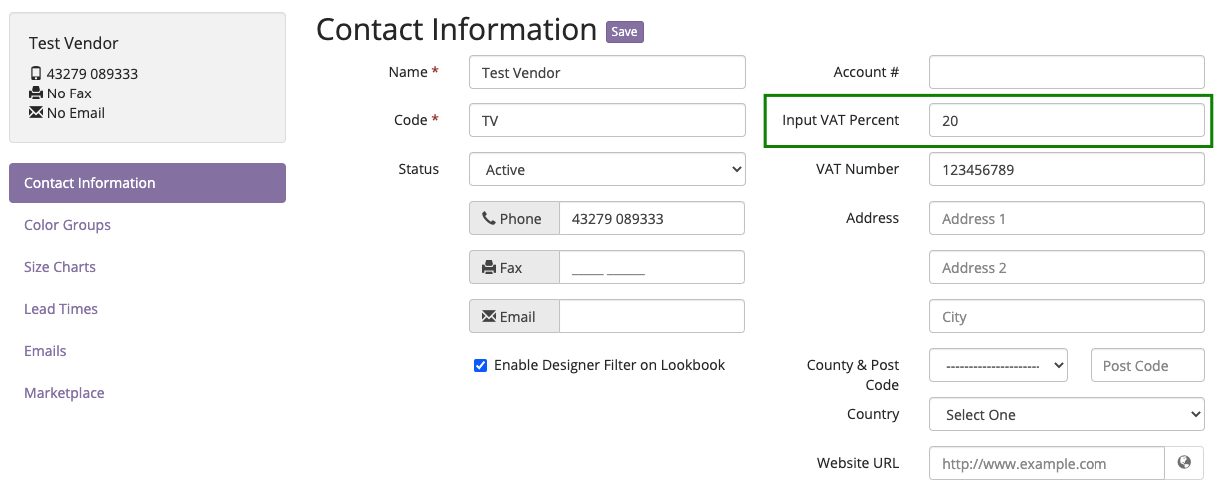

You can update the input VAT percent on the vendor under Inventory > Search Vendors.

Once you have the input VAT on the vendor profile, BridalLive will calculate the input VAT for you automatically when adding items. You can also add the input VAT manually on the item.

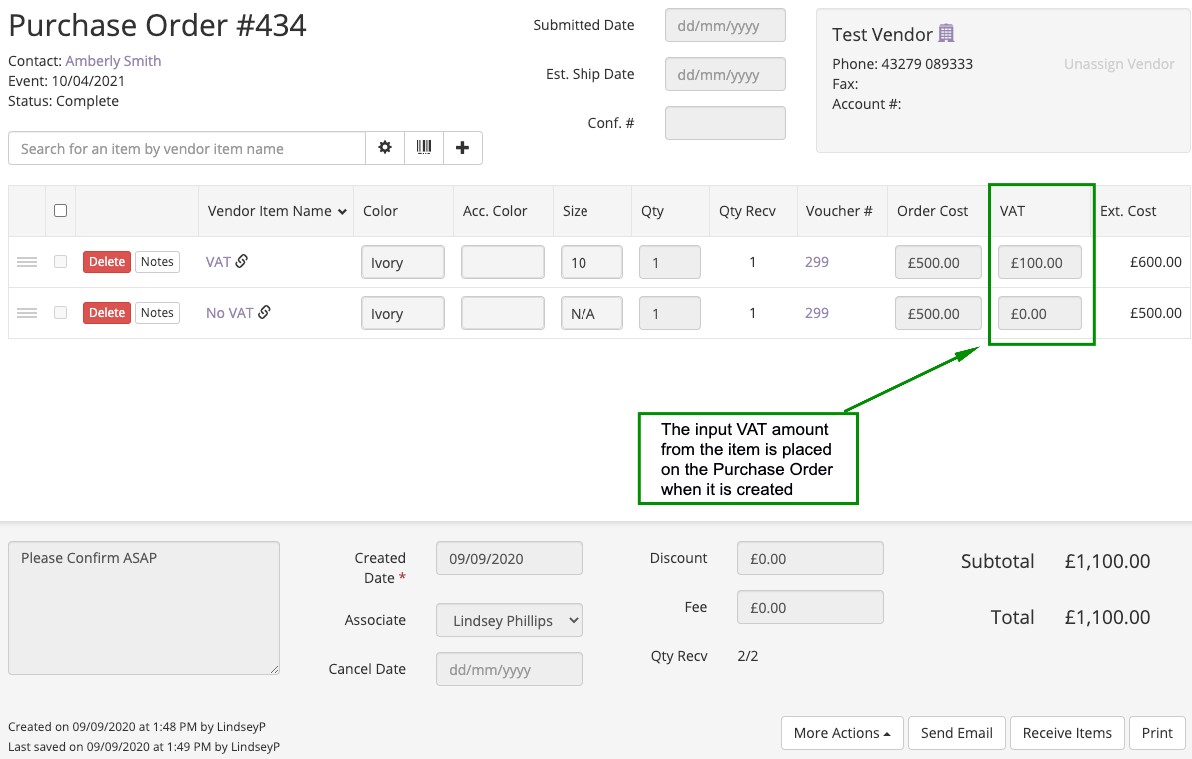

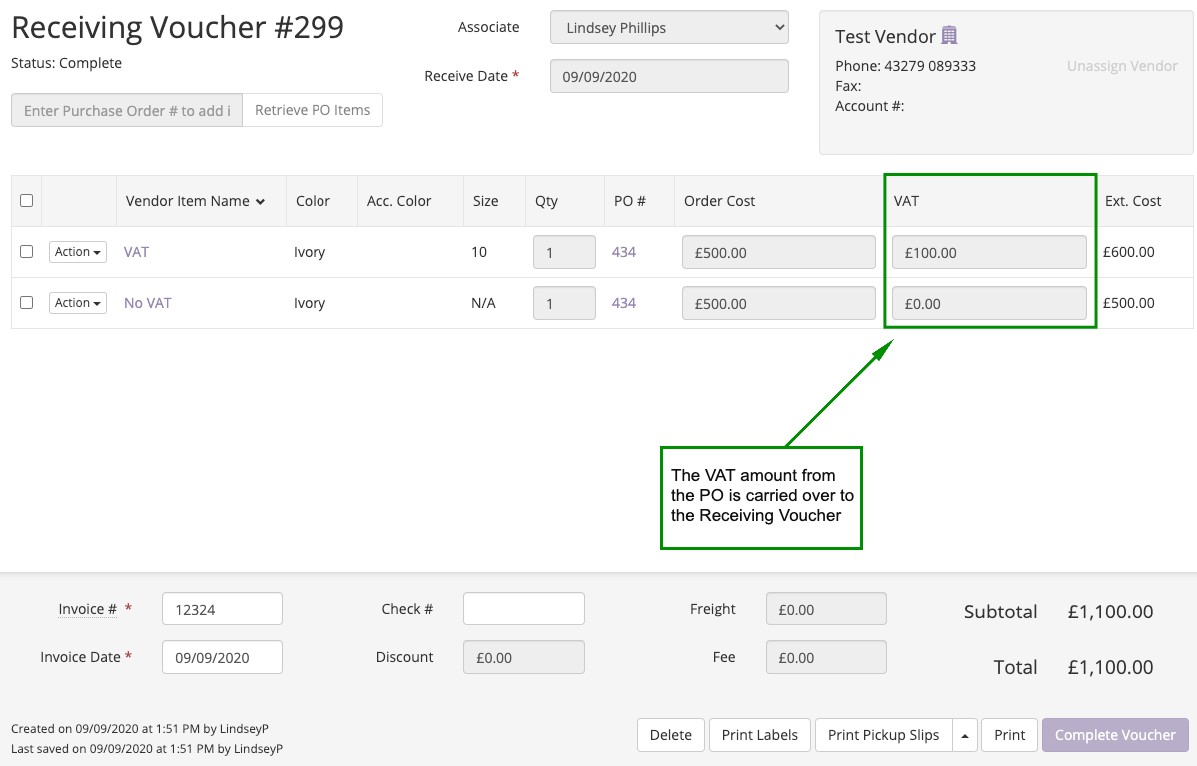

The input VAT is shown on both the Purchase Orders and Receiving Vouchers.

(Purchase Order Screen showing Input VAT amount paid to supplier)

(Receiving Voucher Screen showing VAT paid)

VAT Report

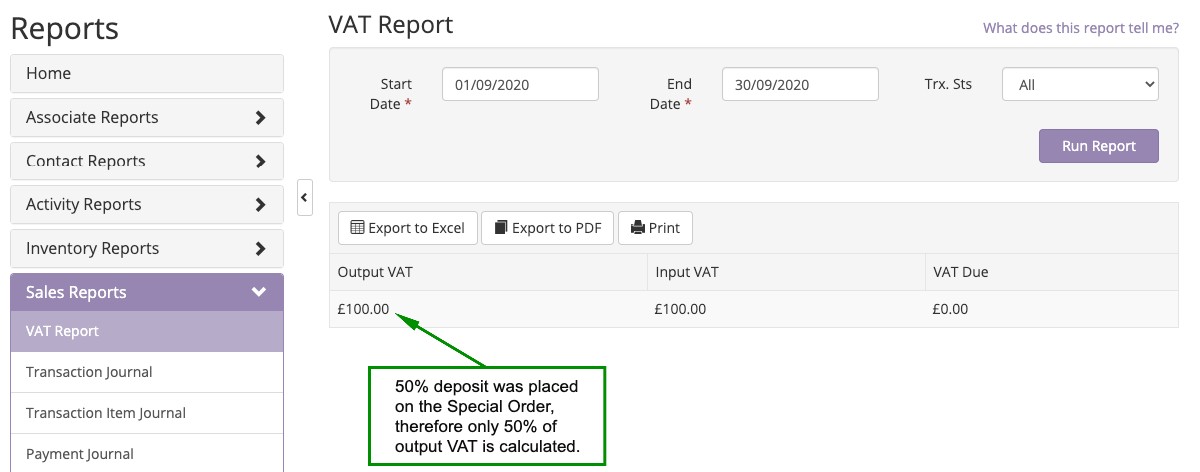

BridalLive can tell you exactly how much VAT to remit/reclaim. The VAT Report is used to fetch this figure. The VAT Report can be located by navigating to Reports Sales Reports VAT Report.

On the VAT Report, BridalLive first looks at the amount of Output VAT that is due. VAT is considered due when the first payment is made. This is considered the "Tax Point". However, only a proportion of the VAT is due. So if a customer puts down 50% of the total as a deposit, only 50% of the VAT is due for that period.

Next, BridalLive calculates the amount of Input VAT paid for items purchased and received during the period.

(The VAT Report calculating the correct amount of Output VAT)