This article contains some very important information that affects how BridalLive accounts for revenue, sales tax and so much more. It is critical that you understand the concept of "Completing" orders so that your books can remain accurate.

According to the Generally Accepted Accounting Principles, a sale is not a sale until the ownership of the merchandise is transferred to the customer. When the sale occurs, Revenue, Sales Tax, Cost of Goods Sold are all realized. Also, the quantity on hand for the item is adjusted.

This means that in BridalLive, an order is completed when the store-owner wants to recognize revenue, sales tax and adjust inventory. This is typically when the merchandise has been received and the order has been paid in full. It is up to the store-owner to consult with their CPA to decide when orders will be completed.

According to the Generally Accepted Accounting Principles, a sale is not a sale until the ownership of the merchandise is transferred to the customer. When the sale occurs, Revenue, Sales Tax, Cost of Goods Sold are all realized. Also, the quantity on hand for the item is adjusted.

This means that in BridalLive, an order is completed when the store-owner wants to recognize revenue, sales tax and adjust inventory. This is typically when the merchandise has been received and the order has been paid in full. It is up to the store-owner to consult with their CPA to decide when orders will be completed.

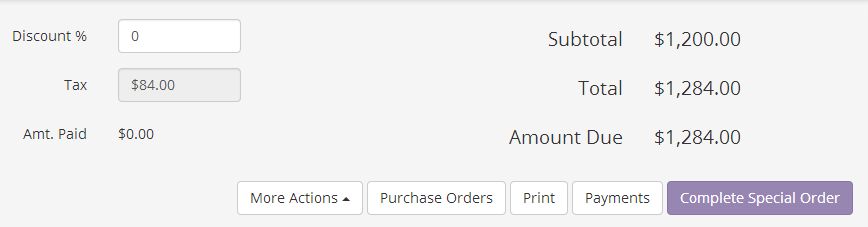

To indicate that you are transferring the merchandise to the customer, you click "Complete Special Order" or "Complete Layaway".

Completing a Special Order/Layaway

When it's time to complete the order, follow the steps below:

- Open the customer's pending transaction

- Click Complete Special Order or Layaway (in the bottom right hand corner)

While this may seem very simple, it is VERY IMPORTANT to do this step every time you want to finish a Special Order or Layaway. This is the only way BridalLive will know that your work on the order is done and it's time to account for your sales as revenue and show your sales tax as due.