This article applies to customers in Europe or Australia. Throughout the article we use VAT as the a general term for the tax that is included in the retail price of your products. If you are in Australia, just substitute the VAT term for GST as you read through the article.

BridalLive helps you calculate how much value added tax (VAT) is due to the government. In order for it to do so, some setup is required. This article walks you through setting up your company to use a VAT.

There are 2 sides to VAT: Input VAT and Output VAT. Input VAT is what you pay to vendors when you purchase goods. Output VAT is what you collect from your customers.

The amount of VAT that you remit to the government is the difference between the amount of VAT you've collected from customers minus the amount of VAT you've paid to suppliers. In other words, VAT to be paid = Output VAT - Input VAT. If setup correctly, BridalLive can make this VAT calculation quick and easy.

To get VAT setup, we will follow a step-by-step process:

- Enter your Company's VAT Number

- Setup your Input VAT

- Setup your Output VAT

- Setup your items for VAT

Once you've finished this setup, you can review the How BridalLive calculates VAT article to see how these settings are applied and how to determine the amount of VAT to remit to the government.

Enter your Company's VAT Number

To have your VAT number printed on customer invoices, you'll want to enter your VAT Number on the Company Profile screen. Having the VAT Number on the printed invoice is a required piece of a valid VAT invoice in many countries.

To add your VAT Number, navigate to Settings Company Profile. You will see the VAT number field on the right-hand side of the screen. If you do not see it, your BridalLive does not think that your country uses a VAT. If you feel this box should be showing, please contact BridalLive support.

(Enter your VAT Number on the Company Profile Screen)

Setup your Input VAT Rate

The next step is to tell BridalLive how much VAT you pay on purchases from vendors. By doing this, BridalLive will be able to automatically calculate the total amount of VAT that you've paid to vendors for each item and also on the VAT Report.

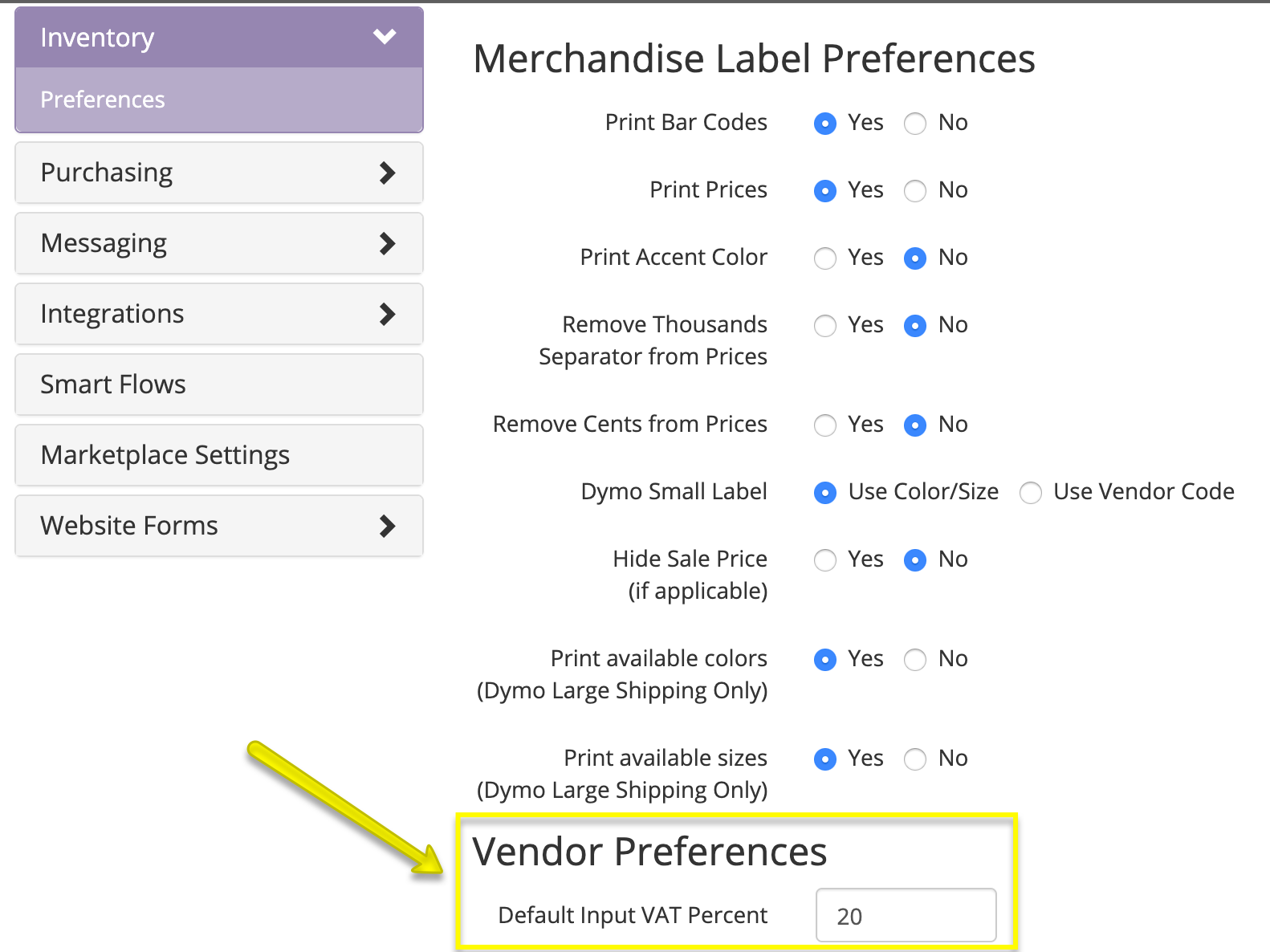

To specify your Input VAT rate, navigate to Settings > Inventory > Preferences. Enter the VAT rate into the box shown below. Be sure to enter it as a full number and not a decimal. For instance, a 20% VAT should be entered as 20 and not .2.

(Enter your Input VAT as seen in the screenshot above)

Setup your Output VAT

The next step is to tell BridalLive how much VAT you plan to collect from customers (Output VAT). To do this, you must set up your VAT and No VAT tax codes by first navigating to Settings Point of Sale Tax Codes.

When setting up your VAT tax code, it is crucial that you specify that the Tax is "Included in Price". This will tell BridalLive that when pricing your items, the VAT amount is already included. BridalLive will then derive the amount of VAT included in the price and show it on the Point of Sale screen and also on the customer invoice.

The screenshot below shows the appropriate settings for the VAT and No VAT tax codes.

(Setup your tax codes just like they appear in the image above)

Setup your Items for VAT

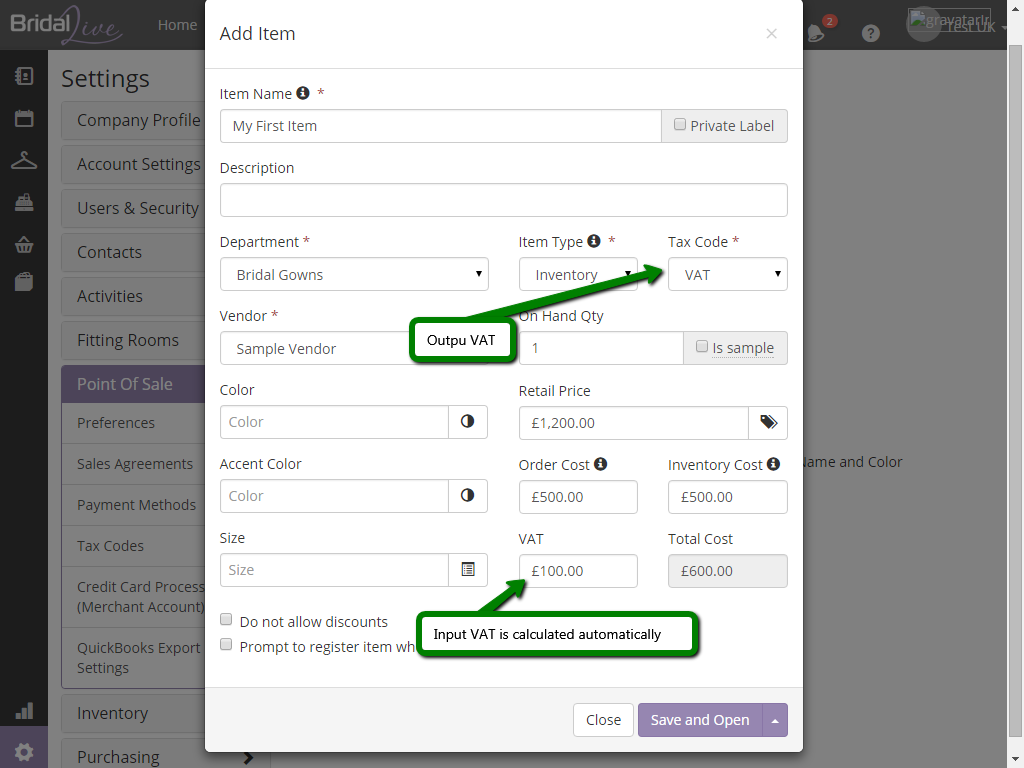

Now that your Input and Output VAT setup is in place, you can now add Items to BridalLive and the VAT amounts will be calculated automatically at the appropriate times (when items are sold and when items are purchased). The image below shows how to assign both the Input and Output VAT to an Item.

First, you'll notice that the Tax Code of VAT is assigned to the item. As you know from Step #2 above, this tax code tells BridalLive that your retail price includes VAT. In this example, the Output VAT amount will be calculated as 200 when the customer purchased the item.

Secondly, the screenshot shows how the Input VAT is calculated automatically when the Order Cost is specified. In our example, the Order Cost is 500 and the Input VAT is calculated as 100 which brings the Total Cost for the item to 600.

(Input and Output VAT assignment on Add Item Screen)

Next Steps

Now that you've setup BridalLive to correctly calculate and track VAT, you can begin selling items to customers and purchasing items from Vendors. BridalLive will track the amount of Input/Output VAT and has reports that you can run to determine how much VAT to remit/reclaim from the government.

To learn more, read our article titled How BridalLive calculates VAT .